Exempting additional payments under the JobKeeper program from payroll tax - announced on 5 May 2020. Reducing profits tax salaries tax and tax under personal assessment for the year of assessment 202122 The relevant legislation was passed by the Legislative Council.

To Take A Refund On Tax While Keeping Or Purchasing Your Uniform Download Uniform Tax Rebate Form Tax Refund Business Budget Template Budget Planner Template

2019 personal and corporate income tax Under the authority of ORS 305157 the director of the Department of Revenue has determined that the governors state-declared emergency due to the COVID-19 pandemic and the action of the IRS will impair the ability of Oregon taxpayers to take certain actions within the time prescribed by law.

. 50 lakh but doesnt exceed Rs. Ii For reference the median household income in New Jersey was roughly 83000 in 2019. Further about 400000 low- to moderate-income workers would receive more tax relief from the credit than they do now.

2017 to 2018. 2016 to 2017. Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives.

Minnesota Management and Budget 658 Cedar Street Saint Paul MN 55155 Subscribe for e-mail updates. Four relief measures have been announced by the Victorian Government. Waiving business registration fees for 2022-23 The relevant legislation was passed by the Legislative Council.

A Budget 2019 measure increased the LMITO values from the 2018-19 year through to 2021-22. As shown in Chart A3 people like Amelie who work eight hours a day at minimum wage throughout 2022 would receive about 40 in additional tax relief for a total of about 870 fully eliminating their PIT for the year. Historical Budget documents are available for reference purposes.

On March 18 Gov. FY 2018-2019 Governors Budget Recommendations. HB 7071 included a provision to suspend the states 253 cents per gallon fuel tax for the month of October.

2018 to 2019. Pursuant to the Balanced Budget and Emergency Deficit Control Act of 1985 which are appropriated for the. However marginal relief is available from surcharge in following manner-a n case where net income exceeds Rs.

2020 to 2021. The Bipartisan Budget Act of 2019 PL. 2019 to 2020.

The LMITO base amount will increase from 200 to. As noted above the ANCHOR proposal would extend property tax relief to households earning between 75000 and 250000 well into the top 15 percent of earners in the state. Waiving of 2019-20 payroll tax for employers with annual Victorian taxable wages up to 3 million - announced on 21 March 2020.

That amount is recorded as mandatory spending in the budget. Get nonpartisan data about the total US debt and the federal budget in 2021 with the State of the Union in. This brings the total tax toll and fee relief under the Hogan administration to nearly 47 billion.

Text for HR1865 - 116th Congress 2019-2020. Published on Apr 4 2022 in Economic Justice Tax and Budget. Still total federal spending in 2022 is about 600 billion higher than it would have been without the relief packages.

Strong Tax Collections Belie Californias. Treasury We are continually updating this website. The relief package also includes increased.

Nil 225 415 665. Of Veterans Affairs Title III--Related Agencies Title IV--Overseas Contingency Operations Title V--Natural Disaster Relief Title VI--General. JB Pritzker on Tuesday signed the states 465 billion budget for 2023.

Income tax relief on Covid-19 treatment expenses and compensation. Sign up for COVID-19 Relief Updates via Email US. The Presidents Budget for Fiscal Year 2023FACT SHEET.

In his 2022-23 Budget the Financial Secretary proposed the following measures. State and local tax revenue increased 192 from FY2020 to FY2021. Brian Kemp R signed HB 304 immediately suspending.

Deferring 2020-21 payroll tax liabilities for. Low and Middle Income Tax Offset. The 2019-20 Budget.

The Franchise Tax Board is expected to begin sending out payments in October based on your 2020 tax returns. Budget Act of 2022Introduced in the Assembly and Senate. Many of the provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 would have.

The corporate income tax rate reductions proposed in Budget 2021 for businesses that manufacture zero-emission technologies will give Canada the lowest combined federal. Tax expenditures contribute to the budget deficit just as federal spending does. Tax Rates 2019-2020 Year Residents.

In late November 2019. 2 billion for the Regional Relief and Recovery. Further address rising prices and return tax proceeds to Californians a central component of the Budget is an over 17 billion.

While eight-tenths of federal pandemic spending was delivered in 2020 and 2021 some primarily for health care state and local education and individual assistance such as through the Child Tax Credit occurs in 2022. Governor Hogan first pledged to pursue retirement tax relief as a candidate in August 2014 and proposed it in his first State of the State address in 2015 promising to act once we solve our current budget crisis. We break down the major changes that could impact your 2020 tax.

2019 shall be inserted with effect from the 1st day of April2023. As Assembly Budget Chair Im proud to announce some relief is on the way to most Californiansthanks to the state budget just enacted which includes about 95 billion in tax rebates. Embed on your website Copy.

FY 2023 Presidents Budget Analytical PerspectivesBudget AppendixHistorical TablesSupplemental MaterialsFACT SHEET. This is responsible for the use of sunset clauses in several recent budget acts when proposed tax cuts commanded majority support but not the. -meal allowance not yet reflected in this data means SNAP funding will remain above pre-pandemic levels after pandemic relief.

1 Crore the amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50 Lakh by more than the amount of income that exceeds Rs 50 Lakhs. The budget includes a plan to issue tax rebates and direct payments among other mostly temporary tax cuts. Budget 2019 announced an investment of 19 billion over 24 years to build and operate.

For four other activitiesdisaster relief wildfire suppression for 2020 and 2021 activities related to the 2020 census. As we release publications aimed at addressing the 2022-23 budget situation we will add them to this index page. Its centerpiece is a refund of up to 1050 that will benefit millions of Californians based on income level and the size of household.

State Gas Tax Holidays Connecticut. The state enacted HB 5501 on March 24 which suspended the states 25-cent motor vehicle fuels tax from April 1 until July 1. Exchequer impact m 2015 to 2016.

But thanks to the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act you might see some relief when you file your 2020 taxes taxes filed in 2021.

Pin By Janna Fox Merriman On Rescore Post Money Lessons Debt Settlement Debt

Pin By Eztax In Free It Gst Filing On Income Tax Filing Software Expert Services Online Taxes Filing Taxes Income Tax Return

What You Need To Know About Tax Deductions Vs Tax Credits Tax Deductions Tax Credits Deduction

How To Solve Millennials Bad Money Habits Budgeting Money Infographic Infographics Finance Personalfina Money Habits Budgeting Money Finance Infographic

Get Organized For Tax Season Tax Season Working Mom Life Tax Prep

Section 87a Tax Rebate Fy 2019 20 Income Tax Return Rebates Wealth Tax

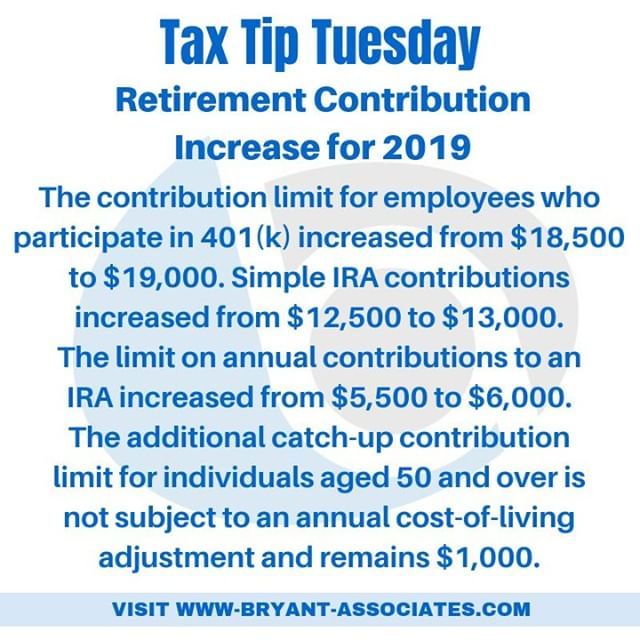

Retirement Contributions Increase For 2019 The Contribution Limit For Employees Who Participate In 401 K Increased Simple Ira Tax Organization Paycheck Budget

Budget 2019 Budgeting Property Tax Deducted At Source

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Highlights Of Interim Budget 2019 As Presented By Finance Minister Mr Piyush Goyal On 1 Feb 2019 Budget2019 Budgethi Budget Highlights Budgeting Finance

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Lower Your Taxes Big Time Lower Your Taxes Big Time 2019 2020 Small Business Wealth Building And Tax Reduction Secrets From An Irs Insider Edition 8 Pap Tax Reduction Small Business

Tds On Cash Withdrawal Tax Deducted At Source Making Cash Cash

Nasscom On Budget 2019 Align Foreign Tax Credit Globally Solve Gst Complexities Nasscom S Recommendation For Budget2019 Budgeting Tax Credits Startup News

February 2019 Budget Recap Budgeting Budget Tracking Sinking Funds

How Is Income Up To 5 Lakhs Tax Free In Budget 2019 Cychacks Income Tax Standard Deduction Budgeting

Top 10 Fun Easy Money Savings Challenges For 2019 Money Saving Challenge Money Saving Strategies Budgeting Money

What Is Tax Loss Harvesting Small Business Tax Deductions Business Tax Deductions Tax Time